When considering granting loans, lenders want to know that a business generates income. Additionally, if audited, the bank business statements can be used as proof that the filed business tax returns were accurate.

Referencing the statements your business received during the tax year can ensure that you can file your taxes correctly. Filing Tax Returnsīusiness bank statements are used as supporting documents for the business’s tax forms. These statements can help to keep your business accurate and organized. This allows a business to better track profit margins and determines how well they are managing their money.ĭownload Template What are Business Bank Statements Used for?īusiness bank statements are an invaluable financial tool for your business.

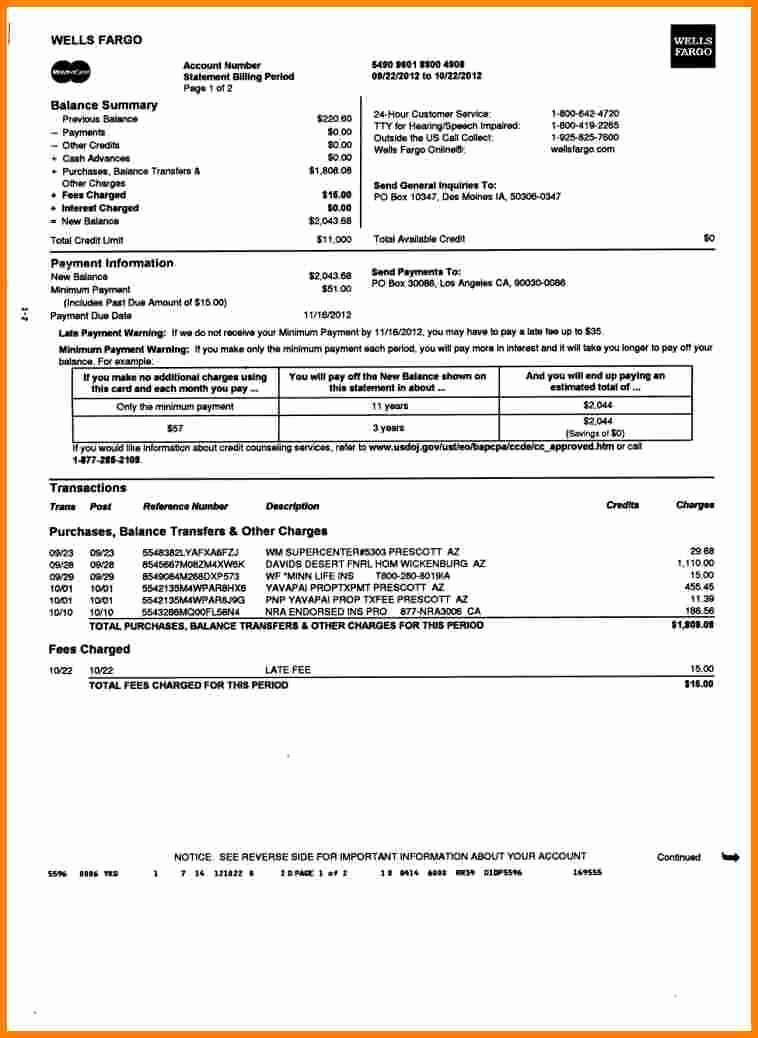

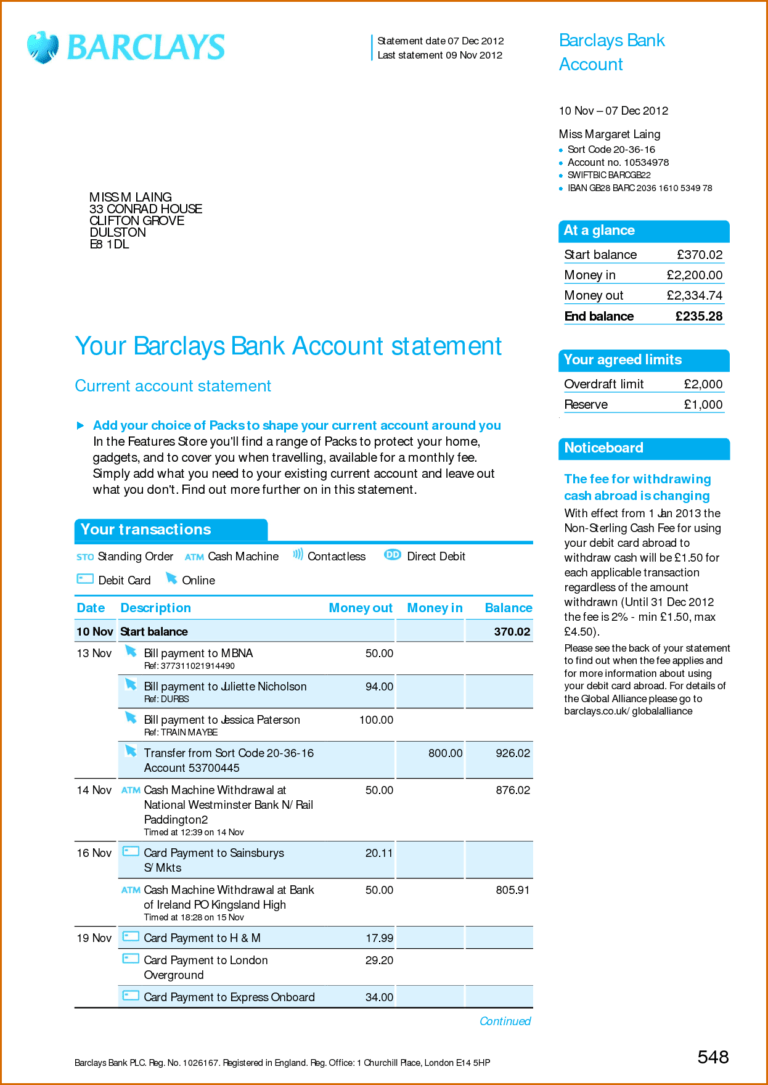

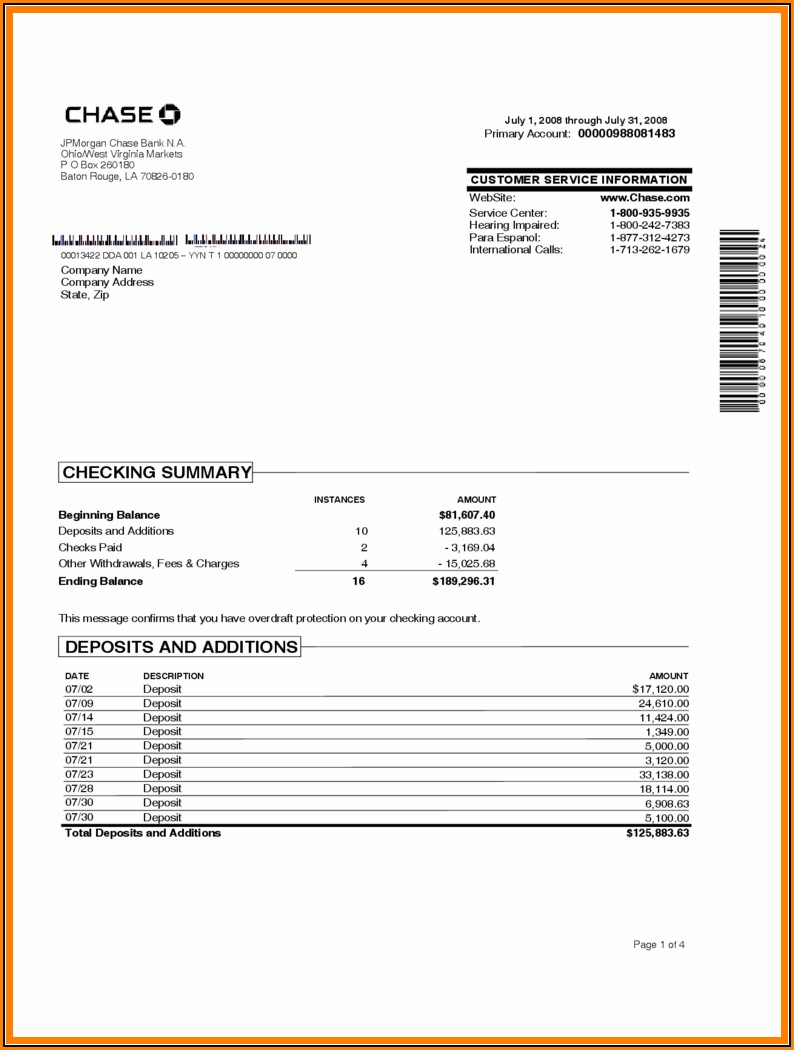

This summary will include the balance at both the beginning and the end of the period, with the total amount of money deposited and withdrawn from the business account throughout the period.Īfter the summary, most banks will break down the transactions made by the business, both income and withdrawals, line by line. Most business bank statements will provide a summary of the account over the statement period, which is traditionally one month.

This section will have a record of the account name and number. Following that is often a section about your business, including the business name, the business address, and the name of the individual who heads the business bank account. The top section traditionally contains the bank’s general information, like the name and address of the bank. If your business chooses paper statements, the statement your business receives should be on the official letterhead of the bank you use. There are some commonalities between all business bank statement templates. Download Template What Does a Business Bank Statement Look Like?īusiness Bank Statements have a variety of appearances depending on which bank your business uses.

0 kommentar(er)

0 kommentar(er)